401(k) Retirement Plans

We work with you to deliver and manage a custom 401(k)/403(b) retirement plan that serves you and your employees, simplifies your work, and minimizes costs… for everyone!

Our Service Model

Whether you are setting up a new retirement plan for your organization or looking to improve your current plan, we help you determine the best fit retirement plan for your organization and your employees.

As part of the process, we seek to understand the goals of the organization and its employees; including:

- Culture

- Growth projections

- Employee retirement expectations

- Retirement plan goals

- Funding

- Risk profile

This is not a one-time effort! We continue to think, understand, and manage the retirement plan according to organizational and industry changes.

We partner with some of the most highly-rated Plan Providers in the retirement space in order to provide our Clients with:

- Advanced employee and employer websites

- Robust financial wellness tools

- Lowest share class investment lineups

- Excellent customer service

- Focus on employee outcomes

* Partnerships not limited to Providers listed

We help bridge the knowledge gap for Plan Sponsors when it comes to implementing, running, and managing a retirement plan. When you partner with us, we help you to:

- Implement a new plan or transition a previous plan

- Inform and educate plan participants

- Identify fiduciary roles and help manage the responsibilities

Not only do we directly support Plan Sponsors, but we also make ourselves available as direct support for employees!

When you choose to work with us, you can expect to see:

- Increased participation in the plan

- Increased salary deferrals into the plan

- Maximum retirement plan effectiveness for you and your employees

- Improved opinions from employees of benefits overall

Creating Maximum Value

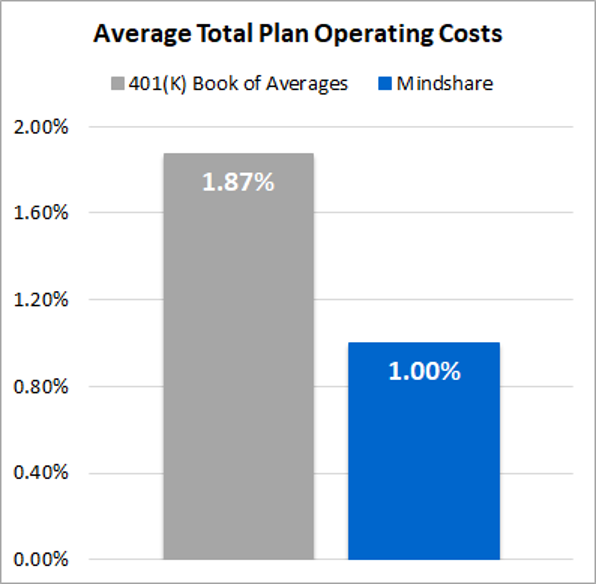

There are 3 main sources of fees when it comes to a retirement plan: plan operation fees, advisory costs, and investment fees.

1. Plan Operation Fees

We keep plan operation costs low by leveraging our industry knowledge and partnership with industry-leading providers to find the right Plan Provider at the right price, negotiating with Providers on your behalf for lower fees

2. Advisor Fees

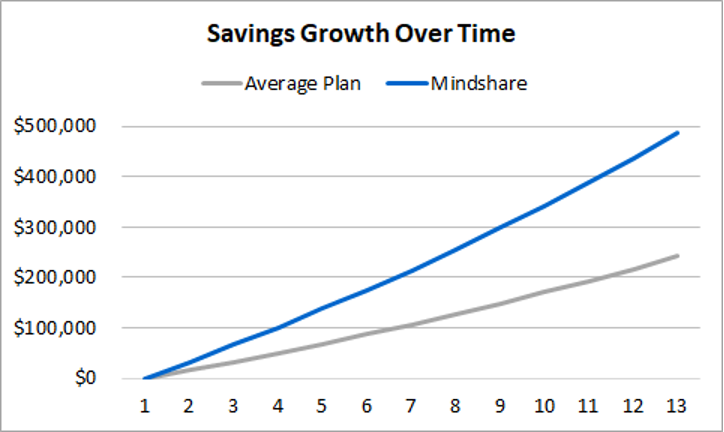

As the Advisor on the Plan, we keep our advisor fees low to encourage increased participation and higher returns for you and your employees! High fees in a retirement plan eats away at the potential growth of retirement savings, so we keep costs low in order to maximize savings!

Assumptions: Salary of $60,000 annual, with 3.1% COLA increase. Employee Contribution rate of 5%. Stocks average annual return of 7.69%. 2.31% annual inflation rate.

Additionally, as a Benefits Firm, when we are managing all other Employer Health benefits, we are able to further reduce our Advisor fees.

3. Investment Fees

We always push for the lowest share class available and recommend a combination of passive (Index) funds and actively managed funds, which gives participant’s the best mix of solid, low-cost investment options and high-performing, market-leading funds.

Passive (Index) mutual funds are funds that are built to mirror a specific market index and perform in-line with that index, without any active fund management decisions. As a result, these funds are lower cost to participants.

Actively managed mutual funds are managed by an investment manager or team who makes the decisions on how and where to invest the fund’s money. These funds are more costly due to their active management, but may provide superior performance.

Ensuring a Perfect Balance of Performance and Risk

We utilize top-of-the line investment evaluation software from industry leader Fi360 to ensure the investments in your plan continue to remain of high-value to plan participants, performing at their maximum level relative to the category risk.

References: (1) Pension Data Source, Inc. (2020). 401(K) Averages Book (20th ed.).